(9/5) AI-powered tools that make it easy to embed fairness into their decision making

Welcome to the 11th edition of the Geeks Of The Valley (GOTV) Newsletter where we share our written memo on startups that have yet to raise any funding or announce it publicly, new startup ideas from some of the most original minds in tech and VC, and also episode of the week from our own GOTV podcast!

🏢 Venture Insights

👥 Team

Kareem Saleh: Previously Exec. VP @ Zest AI (backed by Lightspeed, Insight Partners, Baidu, Oakhouse Partners; raised $250m), Executive @ Softcard (acq. by Google), Senior Advisor to CEO @ US International DFC, Chief of Staff @ US Department of State.

John Merrill: Previously Principal Scientist @ Zest AI, Staff Software Engineer @ Google (built tools to help advertisers through ML), SDE @ Microsoft (worked on AI-powered virtual assistants).

The Sparks ✨

Dismissal for minorities.

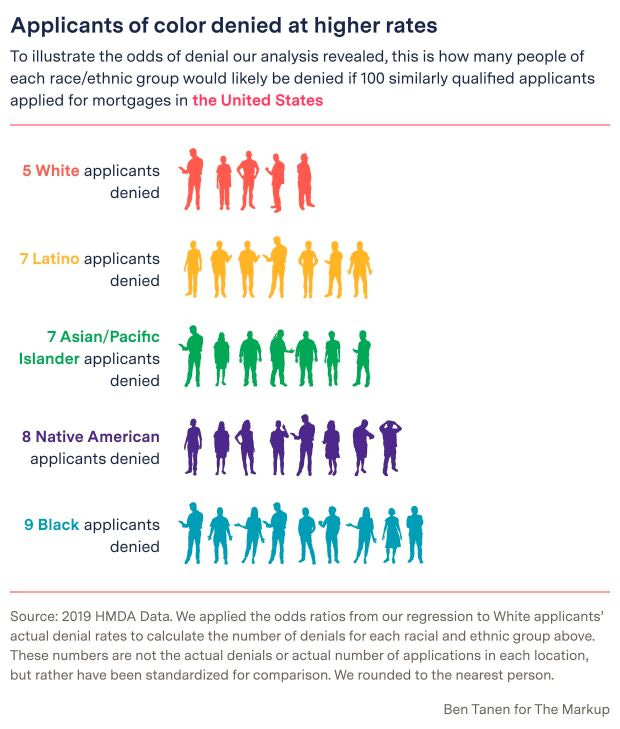

The Markup found that lenders were 40% more likely to deny Latino applicants for loans, 50% more likely to deny Asian/Pacific Islander applicants, and 70% more likely to deny Native American applicants than similar white applicants after monitoring for 17 different factors in a complex statistical analysis of more than 2 million conventional mortgage applications for home purchases.

Lenders were 80 percent more likely to reject Black applications than white applicants. These are national rates. On paper, the potential borrowers of color appeared virtually identical to the white applicants in every case, except for their race.

💡Startup Ideas

KP, Program Director @ On Deck No-Code Fellowship

💡 Episode Of The Week

Ben Narasin is the Founder and General Partner of Tenacity Venture Capital, a pre-Series A venture fund. Immediately previously, Narasin wes a full time investor and Venture Partner at New Enterprise Associates (NEA), one of the worlds largest and oldest traditional venture firms. A prolific entrepreneur and highly regarded early-stage investor with three decades of company-building expertise, Narasin has focused on emerging technologies and new markets throughout his investment career.

With a portfolio comprising key early successes in some of today’s fastest growing sectors, such as fintech, digital marketplaces, mobile and connected devices. His overarching focus in seeking new investments is, in his words, “to find founders whho make me say wow.”

Narasin is a 25-year entrepreneur and 10-year early-stage investor. His knack for spotting emerging trends led him to make seed investments in companies like Dropcam, Lending Club, TellApart, Kabbage and Zenefits. Before NEA, Narasin served as a General Partner at Canvas Ventures, and was prior to that was President of TriplePoint Ventures, the equity arm of TriplePoint Capital, where he oversaw the firm’s seed funding investment activities.

Narasin’s path to investing is rooted in entrepreneurship. He founded several consumer companies before launching his investing career, including Fashionmall.com, one of the first e-commerce companies, which he founded in 1993 and led to a successful IPO in 1999. Narasin frequently writes and speaks about technology and investing, as well as food and wine, a lifelong passion. He holds a B.A. in Entrepreneurial Studies from Babson College.

Thanks for reading! See you next time, geeks 👋

If you know anyone that you’d like to be featured in our podcast, feel free to send a note to geeks@geeksofthevalley.com or reach out here!