(20th August) $2B Visa-acquired executive building fintech automation platform

Also: What are Layer 1 and Layer 2 Blockchains?

Welcome to the 40th edition of the Geeks Of The Valley (GOTV) Newsletter, where we curate exciting ideas/insights on web3 + interesting early-stage/pre-funded companies every 1-2 times per week. If you enjoy and want to keep abreast with insights and interesting early-stage startups before they go big, subscribe to this newsletter ✌️.

Geeks of the week

Startup name: Socket

One-liner: Your Web3 Privacy Connection; Discover friends and projects without revealing net worth and balances.

Founder(s) background: Stanford alum, Research @ NASA & Schmidt Futures, Engineering @ Google & Apple.

Raised $$ / backed by: NA

Startup name: Bits Technology

One-liner: Automate all layers of open finance.

Founder(s) background: Head of Product Design & Engineering manager @ Tink (acq. by Visa), Design lead @ Primer (backed by ICONIQ, Balderton, Accel, Speedinvest), Senior Design Lead @ Klarna, Startups manager @ AWS.

Raised $$ / backed by: NA

Into the 🐰🕳️

(This article was originally written by Quai Network)

What are Layer 1 and Layer 2 Blockchains?

Some of the most contentious modern blocin debates revolve around “how to scale,” or how to accommodate more transaction volume while remaining secure and decentralized. Many believe that the best mechanisms to scale are by creating better, more efficient blockchains — known as Layer 1s — while others believe that building off-chain options — known as Layer 2s — that settle to existing blockchains is the path forward.

What is a Layer 1?

But what is the difference between a Layer 1 and a Layer 2? Simply, a Layer 1 is what we traditionally think of as a “blockchain” — a network of computers that come to consensus on some form of information in a decentralized and trustless manner. Some examples of Layer 1s are Bitcoin, Ethereum, and Quai Network. All of these platforms have a native token (BTC, ETH, and QUAI respectively) that can be transferred between users. Layer 1s are traditionally public and permissionless, meaning that any computer can enter and exit the network as a node or miner at will.

But what happens when there’s more transaction volume than the Layer 1 can handle? Traditional Layer 1s like Bitcoin and Ethereum have strict upper limits on how many transactions-per-second can be processed. When demand exceeds these limits, bidding wars begin to get transactions included on the blockchain, leading to the high transaction fees we all know and hate.

What is a Layer 2?

The primary path forward for traditional Layer 1s is to scale through Layer 2s, or off-chain channels. These work by creating a separate, often privately maintained ledger where each transaction is not executed on the Layer 1. These Layer 2s, or side-channels, can process massive amounts of transaction volume, because they do not experience the same block space limitations as the Layer 1.

In the context of Layer 1s and Layer 2s, Layer 1s are often referred to as the “settlement layer,” where transactions that occur on the Layer 2 are eventually “settled,” or confirmed by the Layer 1.

In the case of Bitcoin, scalability is occurring on the Lightning Network — a Layer 2 solution where users deposit funds into a two-party Bitcoin multisig wallet, where funds can only be transferred if both users agree on the transaction. Both parties have the option to unilaterally exit the agreement at any point, meaning that funds in the Lightning Network can always be redeemed for on-chain Bitcoin.

The most common example used to analogize the Lightning Network is a bar tab — two individuals enter a trusted agreement, where not every transaction is immediately “settled.” These tabs can enable potentially unlimited peer-to-peer transactions to occur, with settlement only having to occur at the end of each tab.

For Ethereum, the future of scalability is also in the form of Layer 2s, although much less uniform. There are a variety of technologies being used to create off-chain solutions for Ethereum, including Optimistic Rollups, ZK Rollups, Validium, and Plasma. There are more than 15 Ethereum Layer 2s with more than $1 million TVL, demonstrating extreme diversity in the Layer 2 ecosystem.

While this diverse ecosystem has led to impressive technological advancements, the sheer number of legitimate Layer 2s brings its own problems — the more users are split into non-interoperable Layer 2 solutions, the less effective Layer 2s as a whole are at minimizing on-chain activity. Without a universal or native solution, Ethereum Layer 2s have to compete for adoption against each other, creating a convoluted and inefficient environment where users have to either choose a Layer 2 ecosystem to silo themselves into, or remain on-chain with high fees.

While Layer 2s are widely accepted as the optimal scalability solution by traditional Layer 1s like Bitcoin and Ethereum, a new generation of Layer 1s, such as Quai Network, attempt to accommodate more transaction volume within the Layer 1 itself instead of resorting to off-chain solutions.

Better Alternatives: What is Quai Network?

Quai Network essentially integrates Layer 2 solutions natively into the Layer 1, where users never have to compromise security or interoperability for low-cost transactions. Quai Network achieves this through a combination of merged mining and sharding, allowing miners to secure multiple chains with the hashpower they produce.

To read more about the merged mining, check out our article “An Introduction to Merged Mining”

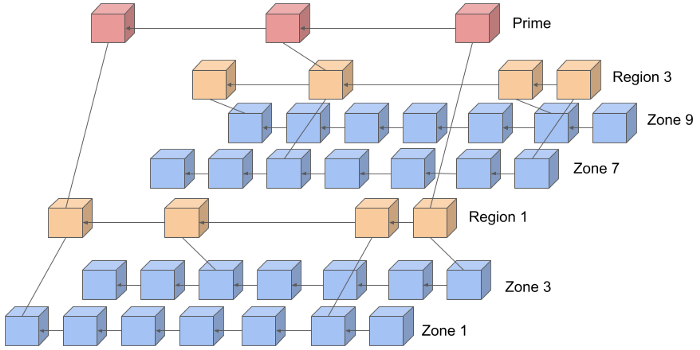

Quai Network exists in a hierarchical structure, beginning with the single Prime Chain, mined by all Quai Network miners. The Prime Chain is sharded into three Region Chains, which are each sharded into three Zone Chains. Each of these chains produce blocks asynchronously, with security ensured throughout the hierarchy by coincident blocks.

To read more about Quai Network’s hierarchical structure, check out our article “What are the Prime, Region, and Zone Chains in Quai Network?”

With a 13-chain EVM-compatable modular network, Quai Network natively supports cross-chain transactions between all chains. This allows users to spend and receive funds from any chain, with any state change eventually being confirmed by the Prime Chain, which is the chain secured by 100% of network hashpower.

Through this novel combination of sharding and merged mining, Quai Network achieves a user-friendly, low-fee, and high-speed blockchain network that remains extremely decentralized and secure.

Quai Network is approaching its third Testnet, the Iron Age Testnet, with a variety of bounties for both miners and developers. With 12 million Quai tokens up for grabs, the Iron Age Testnet will be a prime opportunity to explore the network and its capabilities while earning Mainnet Quai tokens.

To read more about the Iron Age Testnet and its incentives, check out our article “Quai Network Iron Age Testnet”